22+ montana paycheck calculator

The bonus calculator aggregate method The bonus calculator percentage method The 401k payroll calculator. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Montana Wage Calculator Minimum Wage Org

This Montana hourly paycheck.

. The GrossUp paycheck calculator. Your average tax rate is 1198 and your marginal tax rate is. Use ADPs Montana Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Simply enter your payroll information to estimate your. The hourly paycheck calculator. As an employer in Montana you have to pay unemployment compensation to the state.

Back to Payroll Calculator Menu 2013 Montana Paycheck Calculator - Montana Payroll Calculators - Use as often as you need its free. Ad Compare 5 Best Payroll Services Find the Best Rates. Just enter the wages tax withholdings and other information required.

Some states follow the federal tax year some. If you make 70000 a year living in the region of Montana USA you will be taxed 12710. The Montana Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Montana State.

Montana Income Tax Calculator 2021. The state income tax rate in Montana is progressive and ranges from 1 to 675 while federal income tax rates range from 10 to 37 depending on your income. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022.

Enter your info to see your take home pay. This free easy to use payroll calculator will calculate your take home pay. Need help calculating paychecks.

The rate jumps to 200 on. Payroll pay salary pay check. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your.

Calculate your Montana net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Montana. The 2022 rates range from 1 to 675 on the first 35300 in wages paid to each. Montana Hourly Paycheck and Payroll Calculator.

So the tax year 2022 will start from July 01 2021 to June 30 2022. The tax brackets in Montana are the same for all filers regardless of filing status. The first 3100 you earn in taxable income is taxed at 100.

It is not a substitute for the advice of. The W-4 Assistant 2016 Canadian Payroll Calculator 2016 There is no charge to use our paycheck calculators. The state tax year is also 12 months but it differs from state to state.

The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Montana residents only. SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. Make Your Payroll Effortless and Focus on What really Matters.

Calculating your Montana state income tax is similar to the steps we listed on our Federal paycheck calculator. Supports hourly salary income and multiple pay frequencies.

Pdf 2015 Risp Web 2 Pdf Sheryl A Larson Academia Edu

Florida Food Stamps Eligibility Guide Food Stamps Ebt

12 Best Realtors In The Us 2022 Rankings Houzeo Blog

Paycheck Calculator Take Home Pay Calculator

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

Ibuyer Reviews Rankings Pros Cons And Alternatives

Montana Paycheck Calculator Adp

Free Paycheck Calculator Hourly Salary Usa Dremployee

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

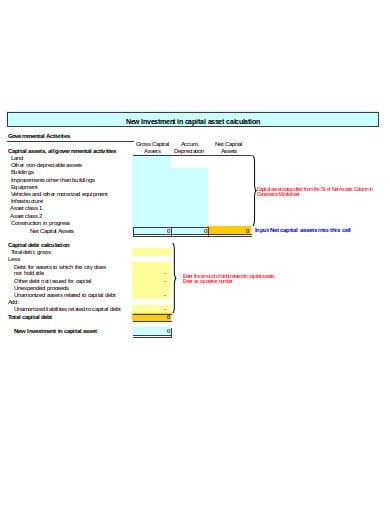

11 Investment Templates In Excel Free Premium Templates

Kink Com Reviews What Is It Like To Work At Kink Com Glassdoor

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Montana Payroll Calculator Calculate Net Paycheck State And Federal Taxes Estimate Salary In Montana

Pdf Simultaneous Low Level Determination Of Iodine And Manganese In Biological Materials By Radiochemical Neutron Activation Analysis Borut Smodis Academia Edu

Payrollguru Ios Payroll Applications And Free Paycheck Calculators

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Who Would Win In A Fight Montana Class Bb Or Yamato Class Quora